Opening up of the Family PIF

15th October 2025The Guernsey Financial Services Commission today launches a new limited POI licence, making it easier for fiduciary firms to administer Family Private Investment Funds. This initiative reflects the Commission’s ongoing commitment to reduce regulatory barriers, enable innovation and ensure Guernsey remains a leading jurisdiction for private wealth services. This follows the Commission’s announcement in May of a streamlined Private Investment Fund (PIF) regime.

A PIF is a class of Guernsey regulated collective investment scheme. PIFs are private in nature and are not permitted to be widely promoted to the general public. A PIF is required to appoint a Designated Administrator, and such party is required to be licensed under the Protection of Investors (Bailiwick of Guernsey) Law, 2020 (the POI Law). Typically, the Designated Administrator function is fulfilled by an appropriately licensed firm which is part of the mainstream fund administration sector.

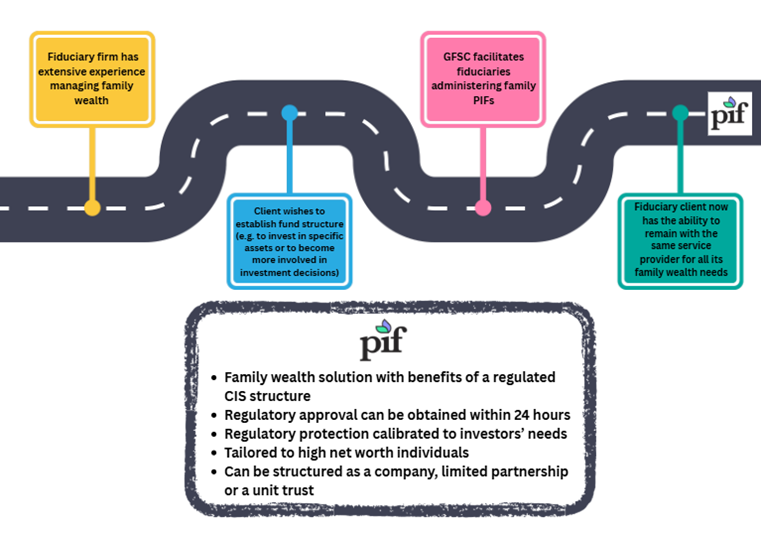

In the case of a Family PIF, all investors must share a family relationship or be an eligible employee of the family (this includes employees of a family office structure). The Commission recognises that the type of investors who might wish to establish and invest in a Family PIF will often be clients of firms in the fiduciary sector, however fiduciary firms are unable to administer a Family PIF unless they also hold a licence under the POI Law.

Where a firm licensed solely under the Regulation of Fiduciaries, Administration Businesses and Company Directors, etc (Bailiwick of Guernsey) Law, 2020 as a primary licensee wishes to act as the Designated Administrator of a Family PIF and has no intention of conducting any other activities which fall within the scope of the POI Law, the Commission welcomes an application for it to be granted a limited POI licence. This may be advantageous to firms who are already managing family wealth via traditional fiduciary structures, and wish to broaden their product offering to enable their clients to benefit from a regulated fund structure.

The Commission will charge a reduced annual licence fee of £1,000 for this type of licence. Further, whilst holders of a limited POI licence must comply with the POI Law in the same manner as any other POI licensee, certain rules will be modified given the restricted nature of the investment activities which may be undertaken. Further details may be found on the Guidance Note here.